Mergers and Acquisition Valuation Services In Mumbai

ValuGenius Advisors LLP leading player in providing comprehensive Mergers and Acquisition consulting services in Mumbai, tailored to your business needs. We provide valuation services that explain how much a company or its assets are really worth. This is very important because it helps people make smart, fair decisions during mergers and acquisitions.

Understanding Mergers and Acquisitions: What’s It All About?

Mergers and Acquisitions (M&A) might sound complicated, but they’re really about companies joining hands or buying each other to grow bigger and stronger. Sometimes, companies merge (come together) to share resources, technology, or customers. Other times, one company acquires (buys) another to expand its business quickly. At ValuGenius Advisors LLP, we are expert corporate advisors who help businesses understand the true worth of companies involved in these deals.

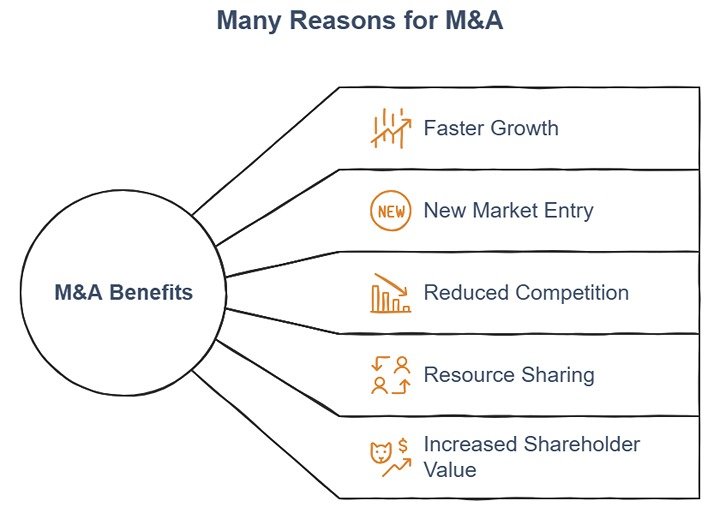

Why Do Companies Choose Mergers and Acquisitions?

Our Mergers and Acquisition Valuation Services

Unlocking True Value for Your Business

ValuGenius Advisors LLP don’t just look at numbers on paper.

Our valuation experts analyze a company’s market position, future potential, and intangible assets like goodwill (the company’s reputation and customer loyalty). This helps us deliver accurate and fair valuations that follow all legal and regulatory rules in India — like the Companies Act, SEBI regulations, and FEMA guidelines.

Our services include:

How We Help You Grow with Confidence

Mergers and acquisitions can be exciting but also challenging. Our team guides you through every step, making the process smooth and clear. We provide strategic insights to help you plan for future growth after a merger or acquisition, so your business thrives.

Real Experiences from Our Clients

- Vinay Parekh

- Sonakshi Desai

Why Choose ValuGenius Advisors LLP?

- Trusted valuation experts with years of experience in valuation in India

- Deep knowledge of Mergers and Acquisition reasons and market trends

- Expert guidance on legal compliance and regulations

- Personalized support tailored to your business needs

- A top Mergers and Acquisition consulting company based in Mumbai

Explore More Services

Want to learn about how we can help your business grow beyond M&A? Check out our other expert services:

Have Questions? Let’s Talk!

Curious about how valuation services can unlock your company’s potential? Need help with merger valuation or understanding acquisition rules?

Reach out to our team at ValuGenius Advisors LLP today. We’re here to guide you with expert advice and clear solutions that fit your goals.