Complete Guide for Valuation Of ESOPs – Challenges & Solutions

Valuation of Employee Stock Option Plans (ESOPs) is a crucial aspect of corporate finance, ensuring compliance with accounting standards and taxation laws. ESOPs are an effective tool for employee motivation, allowing them to own equity in the company and align their interests with business growth. However, improper valuation can lead to common mistakes in financial statements, regulatory non-compliance, and taxation issues.

This guide explores the significance of ESOP valuation, methodologies, challenges, and regulatory compliance, offering insights into best practices for businesses in India, especially those looking for valuation services in Mumbai.

Understanding Employee Stock Option Plans?

ESOPs give employees the right to purchase shares at a pre-determined price, known as the exercise price. The value of an ESOP depends on the fair market value (FMV) of the company’s stock and the exercise price at the time of vesting.

Types of ESOPs

- Incentive Stock Options (ISOs): Tax-advantaged and typically offered to key employees.

- Non-Qualified Stock Options (NSOs): More flexible but have broader tax implications.

Why is ESOP Valuation Required?

- Financial Reporting: Compliance with Ind AS 102 and IFRS 2 for recognizing ESOP expenses.

- Taxation: FMV determination for taxation under the Income Tax Act, 1961.

- Corporate Governance: Transparent disclosures to stakeholders and regulatory bodies.

Valuation Standards & Regulations

Accounting Standards

- Ind AS 102 (Share-Based Payment): Mandates recognizing the fair value of ESOPs as an expense over the vesting period.

- IFRS 2 (Share-Based Payment): Requires fair valuation using models like Black-Scholes or Binomial Method.

Tax Laws

- Section 17(2)(vi) of the Income Tax Act, 1961:

- At Grant: No tax implications.

- At Exercise: The difference between FMV and the exercise price is taxed as a perquisite.

Companies Act, 2013

- Section 62(1)(b): Covers ESOP issuance, shareholder approvals, and mandatory disclosures.

Approaches to ESOP Valuation

Black-Scholes Model: Popular for its simplicity and assumes efficient market conditions.

Formula: C = S * N(d1) – X * e^(-rt) * N(d2)

Where:

- C = Call option value

- S = Current stock price

- X = Exercise price

- t = Time to maturity

- r = Risk-free interest rate

- N(d1), N(d2) = Cumulative normal distribution functions

Binomial Model: Considers multiple price movement paths, suitable for American-style options.

Monte Carlo Simulation: Best for ESOPs with complex conditions like performance hurdles.

Intrinsic Value Method: Simple but does not account for time value.

Steps in ESOP Valuation Process

- Data Collection: Gather ESOP plan details, grant dates, vesting schedules, and share price history.

- Model Selection: Choose the right model based on company structure.

- Perform Calculations: Ensure accuracy in FMV, volatility, and maturity timelines.

- Prepare the Valuation Report: Include methodology, assumptions, and computed values.

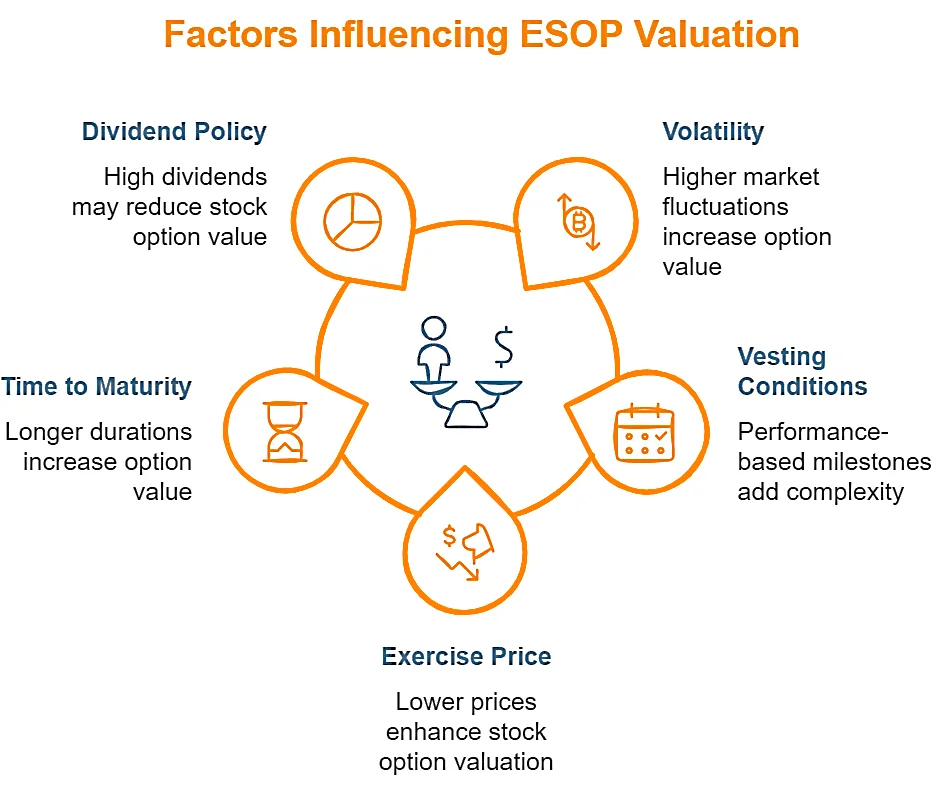

Challenges in ESOP Valuation

- Unlisted Companies: No market price requires alternate methods like DCF or comparable company analysis.

- Data Constraints: Limited historical data affects volatility calculations.

- Regulatory Updates: Frequent tax and accounting changes impact valuation approaches.

- Subjectivity in Assumptions: Employee turnover and performance hurdles require careful judgment.

Practical Applications of ESOP Valuation

For Startups

- ESOPs are an attractive tool due to limited cash flow.

- Startup valuation often relies on Discounted Cash Flow (DCF) methods.

- The role of financial projections in startup valuation is crucial in estimating FMV.

For Listed Companies

- ESOP valuation is based on live stock prices and historical volatility.

- Must comply with stringent disclosure norms under Ind AS 102.

Why Choose ValuGenius Advisors LLP?

At ValuGenius Advisors LLP, we offer valuation services in Mumbai with a team of best Chartered Accountants in Mumbai specializing in ESOP valuation, startup valuation, and valuation methodologies. As the best CA firm in Borivali, we provide precise valuation reports ensuring regulatory compliance and transparency.

Looking for expert ESOP valuation services? Contact CA in Mumbai at ValuGenius Advisors LLP today to ensure your business stays compliant and ahead of the competition!