Types of Financial Models and Valuation Methods

Financial models are essential tools for businesses. Every financial decision, whether it involves budgeting or investment, relies on these models. If you’re interested in understanding different types of financial models, their uses, and their relevance, this article will guide you through the most commonly used financial models. Let’s dive in!

What is Financial Modeling?

Financial modeling is the process of creating a summary of a company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision. In simpler terms, it’s about predicting future financial performance based on historical data, assumptions, and calculations.

Every business creates financial models to forecast future costs, revenue, investments, and more. Here’s how it works:

- Historical Data: Collecting data from the past 3-5 years.

- Current Industry Information: Using up-to-date industry data.

- Assumptions: Making educated guesses about future performance, market conditions, etc.

Most financial models are built using spreadsheet software like MS Excel due to its versatility and ease of use.

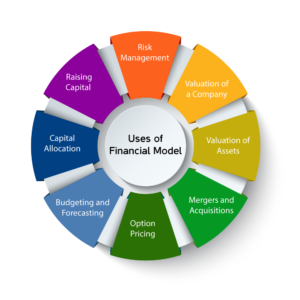

Essential Uses of Financial Modeling

Financial models are powerful tools in the business world. They are used to:

-

- Make strategic investments.

- Compute budgeting and forecasting.

- Price securities like debt or equity.

- Execute mergers and acquisitions.

- Manage portfolios and raise capital.

- Evaluate and assess business valuation.

- Prioritize profitable investment avenues.

These models play a crucial role in the growth and development of businesses.

Distinct Types of Financial Models

Here are some commonly used financial models:

1. Three Statement Model: Integrates the income statement, balance sheet, and cash flow statement.

2. Discounted Cash Flow (DCF) Model: Uses future cash flows and discounts them to the present value.

3. Mergers & Acquisitions (M&A) Model: Assesses the impact of a merger or acquisition.

4. Leveraged Buyout (LBO) Model: Evaluates transactions involving significant debt.

5. Sum of the Parts (SOTP) Model: Values each business segment separately.

6. Comparable Company Analysis (CCA): Compares similar companies to value a business.

7. IPO Model: Used when a private company goes public.

8. Option Pricing Model: Calculates the value of options.

Three Statement Model

This model integrates three key financial statements: income statement, balance sheet, and cash flow statement. It’s used to create a single, organized forecast. The first step involves compiling historical data and assumptions to drive the forecasting process.

Discounted Cash Flow (DCF) Model

The DCF model builds on the three-statement model to predict future cash flows and discount them back to present value. It’s used to value investments, acquisitions, and business expenditures.

Mergers & Acquisitions (M&A) Model

This model is essential for companies considering mergers or acquisitions. It helps estimate the impact of these transactions on future earnings and valuations.

Leveraged Buyout (LBO) Model

An LBO model evaluates the acquisition of a company using a significant amount of debt. It aims to maximize returns on equity investment by leveraging debt.

Sum of the Parts (SOTP) Model

Used by conglomerates, the SOTP model values each business segment separately and combines them to get the total value of the firm.

Comparable Company Analysis (CCA)

Also known as “Comps,” this model compares similar companies to determine valuation multiples like EV/EBITDA, helping in IPOs, mergers, and restructurings.

IPO Model

An IPO model is used when a private company decides to go public. It helps determine the company’s value before listing its shares on the stock exchange.

Option Pricing Model

This mathematical model calculates the theoretical value of an option. The Black-Scholes model and the Binomial Pricing model are commonly used methods.

Conclusion

Understanding these financial models is crucial for making informed business decisions. Each model has a specific purpose and helps in various aspects of financial planning and valuation.

ValuGenius Advisors LLP, as Business Valuation Experts, offers comprehensive services including startup valuation and valuation of goodwill. To learn more about financial modeling and our services, visit www.valugenius.in.