Valuation of Companies for Mergers & Acquisitions – Expert Guide

In today’s fast-paced business landscape, precise valuation of companies is a critical factor in driving successful mergers and acquisitions. As leading registered valuers specializing in M&A transactions, we offer an in-depth examination of valuation methodologies, enriched with practical insights and real-world case studies.

Understanding the Valuation Landscape

Modern businesses present unique complexities that necessitate an advanced approach to valuation. Beyond conventional financial indicators, today’s valuations must also account for technological assets, intellectual property, market positioning, and future growth prospects. This robust framework underpins strategic decision-making in M&A transactions.

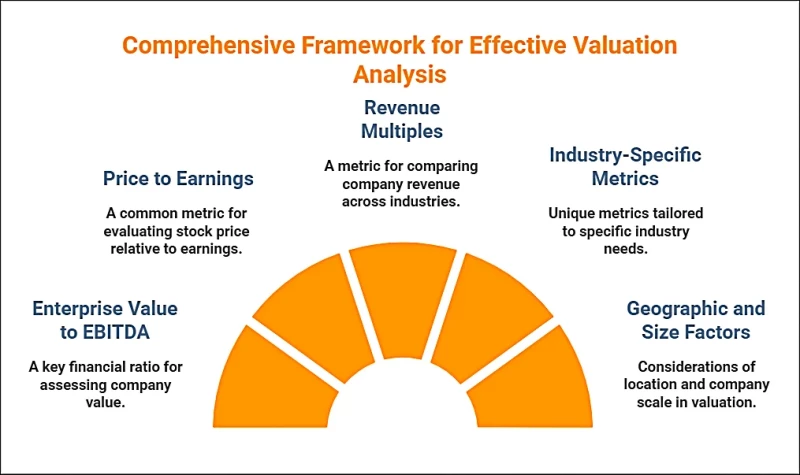

Key Valuation Methodologies

1. Asset-Based Valuation

This technique evaluates a company’s net asset value by adjusting book values to align with current market conditions. While particularly relevant to asset-intensive industries, this approach demands careful assessment of intangible assets and goodwill. Contemporary asset-based valuations increasingly incorporate intellectual property portfolios, brand equity, and digital assets.

2. Market Approach

This method utilizes comparable company transactions and market multiples to determine valuation benchmarks.

3. Income-Based Approach

The Discounted Cash Flow (DCF) analysis is a cornerstone of modern valuation techniques. This approach involves:

- Comprehensive financial modeling

- Analyzing growth potential

- Evaluating working capital needs

- Projecting capital expenditures

- Calculating terminal values

- Applying risk-adjusted discount rates

Case Study 1: Technology Sector M&A

Transaction: Acquisition of a Cloud Services Provider

Valuation Challenge: Traditional metrics fell short in capturing the value of the target’s proprietary technology and subscription-based revenue model.

Approach:

- Implemented a hybrid valuation model integrating:

- Recurring revenue metrics

- Customer acquisition costs

- Lifetime value analysis

- Technology asset valuation

- Market positioning premium

Outcome: The final valuation was 30% higher than preliminary market-based estimates, supported by strong growth indicators and technological strengths. The acquisition exceeded performance expectations.

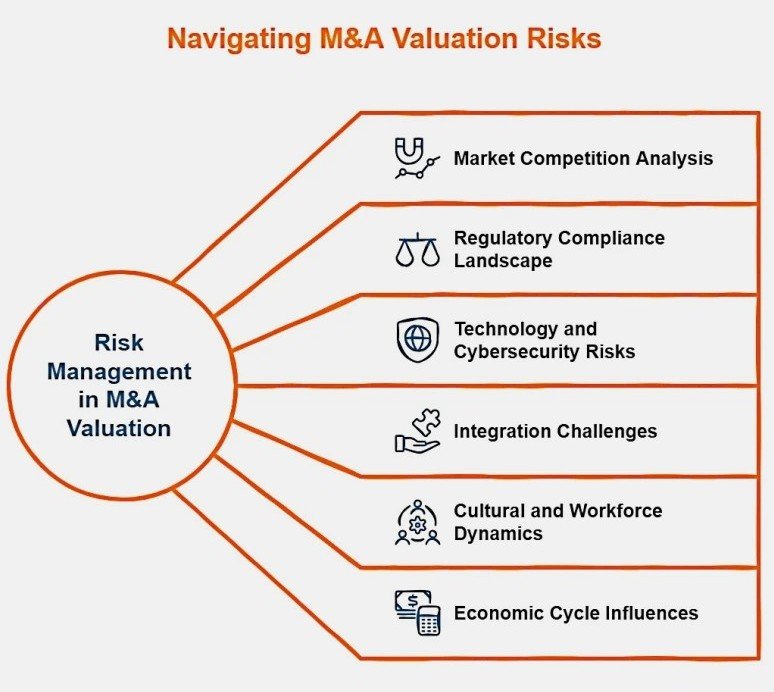

Special Considerations in Modern M&A

Synergy Valuation

Sophisticated synergy analysis is vital in contemporary M&A deals, encompassing:

- Operational efficiencies

- Market expansion possibilities

- Technology integration benefits

- Cross-selling opportunities

- Supply chain enhancements

- Talent acquisition value

Case Study 2: Manufacturing Sector Integration

Transaction: Cross-border acquisition of a niche manufacturer

Valuation Challenge: Quantifying operational synergies and technology transfer advantages

Approach:

- Conducted in-depth operational assessments

- Modelled supply chain integration

- Evaluated technology transfer benefits

- Analysed market expansion opportunities

- Optimized working capital

Outcome: Uncovered 15% more synergy value than initially projected, leading to effective price negotiation and smooth post-merger integration.

Digital Transformation Influence

Modern valuations must account for digital readiness and transformation potential:

- E-commerce integration

- Data analytics capabilities

- Automation potential

- Digital customer engagement

- Cybersecurity infrastructure

- Legacy system evaluation

Case Study 3: Retail Sector Digital Transformation

Transaction: Acquisition of an e-commerce platform by a traditional retailer

Valuation Challenge: Balancing traditional retail metrics with digital expansion potential

Approach:

- Analysed multi-channel revenue streams

- Assessed digital infrastructure

- Valued customer data assets

- Evaluated platform scalability

- Modelled integration costs

Outcome: Structured a deal with performance-based elements, resulting in a successful digital transformation and market growth.

ESG (Environmental, Social, Governance) Impact

ESG factors play a growing role in influencing valuations:

- Environmental sustainability initiatives

- Social responsibility strategies

- Governance structures and compliance

- Stakeholder engagement

- Regulatory risk management

- Reputation enhancement

Case Study 4: Financial Services Sector Merger

Transaction: Merger of regional banks across diverse markets

Valuation Challenge: Navigating complex regulatory requirements and cultural integration

Approach:

- Analysed regulatory capital requirements

- Modelled compliance costs

- Assessed cultural integration strategies

- Evaluated technology platforms

- Reviewed risk management frameworks

Outcome: Achieved a seamless merger with minimal regulatory challenges and strong cultural alignment, realizing targeted cost efficiencies.

Emerging Trends in M&A Valuation

Today’s market conditions require analysis of:

- Remote work impact

- Supply chain resilience

- Accelerated digital transformation

- ESG valuation premiums

- Intangible assets valuation

- Data asset monetization

Actionable Valuation Strategies

To ensure effective valuations:

- Conduct thorough due diligence

- Apply multiple valuation techniques

- Incorporate industry-specific considerations

- Quantify synergy opportunities

- Account for risk factors

- Engage all stakeholders

Why Choose Valugenius Advisors LLP?

Successful M&A valuations demand a nuanced approach that blends traditional methodologies with modern perspectives. Our expertise, as demonstrated through real-world case studies, highlights how detailed analysis and strategic valuation frameworks drive successful transactions. As one of the best CA firms in Mumbai, our registered valuers offer tailored solutions, leveraging decades of cross-industry experience to deliver precise and actionable valuations.

Whether you need Intangible Assets Valuation or are seeking the best Valuation Services in Mumbai, our expert team is here to guide you every step of the way. Contact Best Valuers in Mumbai today to explore how we can support your M&A valuation needs and help you achieve optimal transaction outcomes!